How much can i borrow from my house

The amount of interest youll pay to borrow the principal. We use current mortgage information when calculating your home affordability.

10 Awesome Websites Who Let You Check Your Home S Value For Free Home Appraisal Home Refinance First Time Home Buyers

Fill in the entry fields and click on the View Report button to see a complete amortization schedule of the mortgage payments Bankrate.

. It would be logical to borrow the extra 100 billion for as long as possible and our 50 year yield is 31 So assuming we could borrow at that rate which does have some realism to it because markets have been adjusting to the likely news means a cost of 31 billion a tear going forwards. So youre thinking of buying your first home. The house must also be bought from a builder recognized by the program.

If the same 320000 loan above has a 4 rate then youll pay 12800 for the first year in interest repayment. This information does not contain all of the details you need to choose a mortgage. 03 456 100 103.

We assume homeowners insurance is a percentage of your overall home value. Youll need to obtain an Illustration before you make a decision. Move house remortgage discuss rates or borrow more.

House price growth cools as cost of living weighs on budgets despite August rise. 0800 48 24 48. This mortgage calculator will show how much you can afford.

AOL latest headlines entertainment sports articles for business health and world news. There are many reasons you may want to give a cash gift to your loved ones. As a requirement you must make a 5 deposit and obtain a mortgage to shoulder 75 of the loan.

Mon to Sat 8am - 8pm and Sun 9am - 8pm. Lets look at three key factors before you start shopping. Home buying with a 70K salary.

Find out how much you can afford to borrow with NerdWallets mortgage calculator. How much can you borrow. That 25 limit includes principal interest property taxes home insurance PMI and dont forget to consider HOA fees.

All figures provided by our How much can i borrow mortgage calculator are an estimate only please call us to discuss your requirements in more detail. Paying 500 a month over 25 years means you are paying back 150000 but your mortgage will also include interest - which is charged per. If you make 70K a year you can likely afford a house payment between 1500 and 2000 a month depending on your personal finances.

This will vary among lenders. Use our mortgage calculator to see how much mortgage you can get in the UK how much mortgage you can afford and how much deposit you need for a mortgage. Or 4 times your joint income if youre applying for a mortgage.

2000 cashback when you refinance to us If youre eligible and you apply to move your home loan to us by 28 February 2023 you could get less home load with 2000 cashback. While your personal savings goals or spending habits can impact your. Your salary will have a big impact on the amount you can borrow for a mortgage.

UK house prices jumped at fastest rate in nearly 20 years but Redrow warns of slowing demand 14 September 2022. We can calculate exactly what closing costs will be in your neighborhood by looking at typical fees and taxes associated with closing on a home. The equity loan scheme finances the purchase of newly built houses.

An example would be if you had. Of applicants Salary 1 0. Just enter your income debts and some other information to get NerdWallets recommendation for how big a mortgage.

Use our borrowing calculator to work out how much you could borrow for a home loan to buy a house and what your home loan repayments might be. Calculate your monthly mortgage repayments to see what you could afford to borrow when moving house remortgaging or buying your first home. House poor is a situation where most of your wealth is tied up in your house and much of your income goes toward servicing the mortgage debt and related expenses.

See the average mortgage loan to income LTI ratio for UK borrowers. Mortgage calculators can be useful to get a rough idea of your total borrowing but keep in mind that they are unable to take into account your personal circumstances and therefore there may be additional factors that affect the actual amount you can borrow. New to first direct.

Compare The Market Limited is authorised and regulated by the Financial. How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income. Figure out how much you and your partner or co-borrower if applicable earn each month.

Just because a bank says it will lend you 300000 doesnt mean that you should actually borrow that much. Start by crunching the numbers. Pegasus House Bakewell Road Orton Southgate Peterborough PE2 6YS.

Factors that impact affordability. If you want to. Many first-time homebuyers make this mistake and end up house poor with little.

When it comes to calculating affordability your income debts and down payment are primary factors. How much can I borrow if Im self-employed. You can borrow a minimum of 5 and a maximum of 20 40 in London of the propertys full price.

Find out what you can borrow. It could be to help pay for a wedding a new car or university fees or to help give the younger generation a leg-up onto the property ladderOthers want to gift cash to reduce the value of their estate for inheritance tax IHT purposes with cash gift tax often being far less than the 40. When using our mortgage calculator aim to get as close to what you think your annual salary would be.

FRN310635 and is registered in England and Wales to Greyfriars House Greyfriars Road Cardiff South Wales CF10 3AL company number 03857130. How do lenders decide how much I can borrow. How much house you can afford is also dependent on the interest rate you get because a lower interest rate could significantly lower your monthly mortgage payment.

How Much House Can I Afford Based on My Salary. Existing first direct customers. Your monthly mortgage payment closing costs.

As you begin your house hunting adventure do your homework and figure out how much you can comfortably afford. To calculate how much house you can afford use the 25 rulenever spend more than 25 of your monthly take-home pay after tax on monthly mortgage payments. What mortgage can I get for 500 a month in the UK.

Include all your revenue streams from alimony to investment.

A Book Of Artistic Homes Shown In Rotogravure Illustrating The Work Of Many Of The Most Prominent Small House Architects In America Building Age And National Architect House Vintage House

New American Homes 7th Ed L F Garlinghouse Co Inc Free Download Borrow And Streaming Internet Archive Vintage House Plans House Blueprints Different House Styles

Should I Borrow Against My 401k The Financial Gym The Borrowers Emergency Savings Personal Savings

Pin On Finance

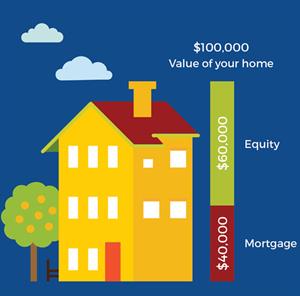

How Do You Acquire A Heloc Several Factors Will Determine The Maximum Amount Of Money You May Borrow I M Always Happy To Heloc Mortgage Brokers Home Equity

Plans For Your Home C L Bowes Free Download Borrow And Streaming Internet Archive Vintage House Plans Small House Bungalow House Plans

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet

Modern American Homes Bawden Bros Inc Free Download Borrow And Streaming Internet Archive In 2022 Vintage House Plans Different House Styles Small Cabin Designs

A Dummies Graphical How To Guide To Getting A Home Loan Home Buying Process Home Improvement Loans Home Mortgage

Flip House Flipping Houses Foreclosures Installation

Loan To Value Ratio Explained Quicken Loans

Home Equity Guide Borrowing Basics Third Federal

Ever Dream Of Your Own Lazy River Check Out This Texas Mansion Just Hitting The Market Mansions Sale House Luxury Homes

Can You Use Home Equity To Invest Lendingtree

Home Equity Loan Vs Line Of Credit Cobalt Credit Union

Pros And Cons Of Home Equity Loans Bankrate

The Loan Vs The Line Of Credit Home Equity Loans Home Equity Loan Home Equity Home Improvement Loans